MEDIA RELEASE: November 2023

Saving money and making financial investments are the primary ways that Bermuda residents prepare for retirement, however, nearly one-half of residents report they have had to change their retirement plans due to economic factors out of their control.

BERMUDA: In these tough economic times we wanted to understand the impact of inflation and cost of living increases on the population’s retirement plans. Currently, two in ten (19%) Bermuda residents report they are already retired, in line with other national findings. Unsurprisingly, residents 55 years and older, lower-income earners (< $75k) and Bermudians are more likely to already be retired compared to their respective counterparts.

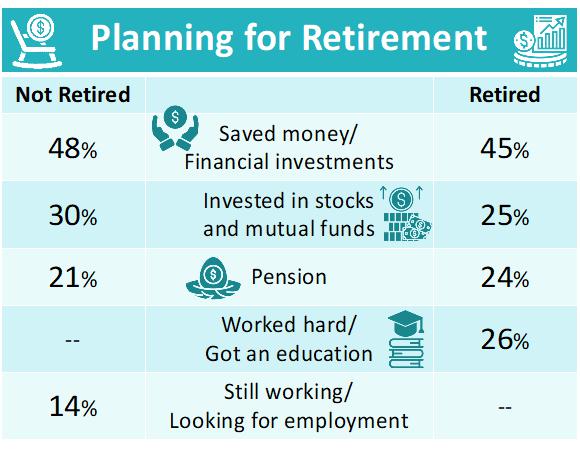

Both retired residents and residents who are not yet retired were asked about their plans for retirement. Among those who are already retired nearly one-half (45%) mention they saved money/financial investments, followed by one-quarter of retired residents who express they worked hard/got an education (26%), invested in stocks and mutual funds (25%) or pension (24%). Among those who are not yet retired, top mentions also include having saved money/financial investments (48%), invested in stocks and mutual funds (30%) and pension (21%).

Among those who are not yet retired, mentions of saved money/financial investments, invested in stocks and mutual funds and pension increases with household income. Further, white residents and non-Bermudians more commonly express they invested in stocks and mutual funds and pension compared to their respective counterparts. Also, high-income earners ($150k+) are more likely to mention investing in real estate/rental income. Across parishes, residents in Pembroke/Devonshire are far more likely to mention they saved money/financial investments.

Lastly, residents who are not yet retired were asked if they had to change retirement plans due to economic factors out of their control. Overall, nearly one-half (46%) report they have had to change retirement plans, while just over one-half (54%) have not. Perhaps unsurprisingly, lower-income earners (< $75k) are more likely to have had to change their retirement plans, compared to those with higher incomes. Moreover, the likelihood of having changed retirement plans increases with age and is greater among white residents.

These results reflect opinions of 225 adult Bermuda residents (18 years or age or older), conducted from August 31st to September 13th, 2023. The questions are not commissioned by a third party and were collected independently by Narrative Research Bermuda. The results were collected from Narrative Research Bermuda’s proprietary online panel of adult residents, Bermuda Voice. Per industry standards, a margin of error cannot be ascribed to online survey results.

For more information, please contact:

Graham Redford, Managing Partner, Narrative Research Bermuda, 278 8882 or graham@narrativeresearch.bm